Solar Panel and Green Loans: Financing Options

Understanding Solar Panel Financing Options and Green Loan Opportunities

So, you're thinking about going solar? Awesome! You're making a smart move for your wallet and the planet. But let's be real, solar panels aren't exactly cheap. That's where financing comes in. Luckily, there are a bunch of different ways to pay for your solar system, and green loans are a big part of that picture. Let's dive into the world of solar panel financing and see how green loans can help you power your home with sunshine.

What are Green Loans and How Do They Relate to Solar Panel Installation Costs?

Green loans are basically loans specifically designed for environmentally friendly projects. Think energy efficiency upgrades, renewable energy installations (like solar!), and even water conservation measures. The idea is to make it easier and more affordable for people to invest in sustainable solutions. Because solar panels definitely fall under that umbrella, green loans are a fantastic option.

These loans often come with perks like lower interest rates or more flexible repayment terms compared to traditional loans. Lenders are incentivized to support green initiatives, and that translates into savings for you.

Exploring Different Types of Green Loans for Solar Energy System Purchase

There are a few different flavors of green loans you might encounter:

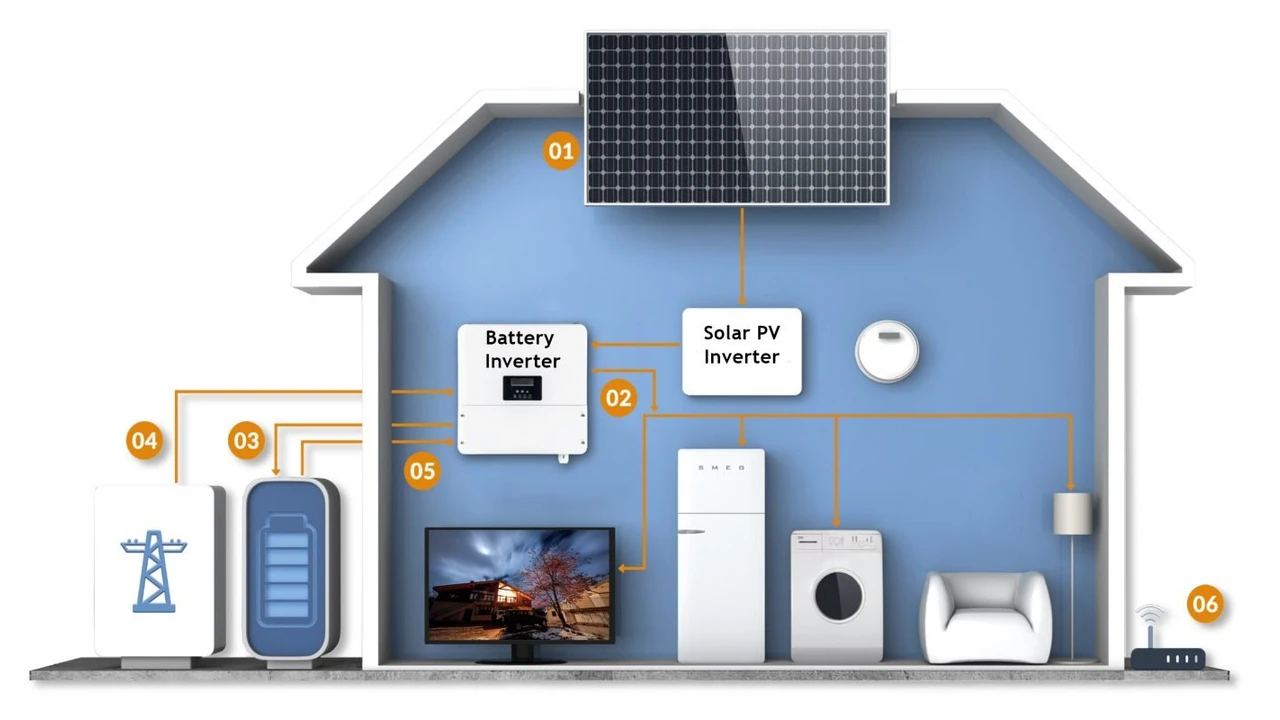

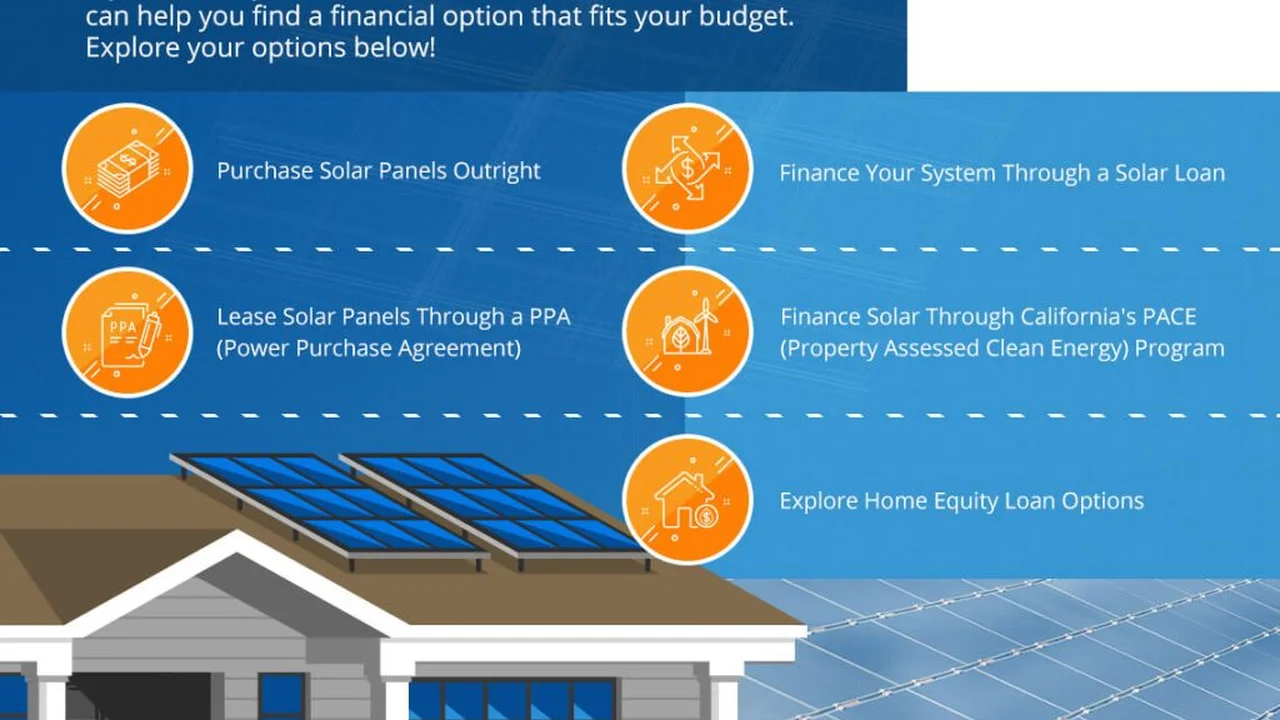

* **Unsecured Personal Loans:** These are your classic loans that don't require you to put up any collateral (like your house). They're relatively easy to get, but interest rates can be a bit higher. * **Secured Loans (Home Equity Loans or HELOCs):** These loans use your home as collateral, which means you can often get a lower interest rate. However, you're putting your home at risk if you can't repay the loan. HELOCs (Home Equity Lines of Credit) give you a revolving line of credit, so you only pay interest on what you borrow. * **Specific Solar Loans:** Some lenders specialize in solar loans. These often have the best terms and are tailored specifically for solar panel installations. They might even offer features like performance guarantees. * **Government-Backed Loans (like PACE):** PACE (Property Assessed Clean Energy) programs allow you to finance solar panels through your property taxes. This can be attractive because the loan is tied to the property, not the individual, but be aware of the potential risks and requirements.Comparing Solar Loan Options Interest Rates Terms and Eligibility Criteria

Okay, so you know your options. Now, how do you choose the right one? Here's what to look for:

* **Interest Rates:** This is the big one. Shop around and compare interest rates from different lenders. Even a small difference can save you a ton of money over the life of the loan. * **Loan Terms:** How long do you have to repay the loan? Shorter terms mean higher monthly payments but less interest paid overall. Longer terms mean lower monthly payments but more interest. * **Fees:** Are there any origination fees, prepayment penalties, or other hidden costs? Read the fine print! * **Eligibility Criteria:** What's your credit score? Do you need to provide proof of income? Different lenders have different requirements. * **Loan Amount:** Make sure the loan covers the entire cost of your solar panel system, including installation.Solar Panel Product Recommendations Installation Scenarios and Price Comparison

Alright, let's talk about some specific solar panels and scenarios to illustrate how financing and green loans play out in the real world.

* **Scenario 1: Small Homeowner on a Budget** * **Solar Panel Recommendation:** REC Group Alpha Series. These panels are known for their high efficiency and reliability, even in partial shade. They're a good balance of performance and cost. * **Installation Scenario:** This homeowner wants to offset a portion of their electricity bill and reduce their carbon footprint. They have a small roof with limited space. * **Financing:** An unsecured personal loan with a low interest rate would be a good option here. They might also consider a specific solar loan if they can find one with favorable terms. * **Price:** A 5kW system with REC Alpha panels might cost around $15,000 - $20,000 before incentives. * **Scenario 2: Large Home with High Energy Consumption** * **Solar Panel Recommendation:** SunPower A-Series. These are premium panels with the highest efficiency and longest warranty on the market. They're ideal for homeowners who want maximum power generation and peace of mind. * **Installation Scenario:** This homeowner has a large roof and high energy bills. They want to maximize their solar production and potentially even sell excess energy back to the grid. * **Financing:** A secured loan (HELOC) could be a good option here, as the homeowner likely has significant equity in their home. A specific solar loan with a performance guarantee would also be attractive. * **Price:** A 10kW system with SunPower A-Series panels could cost around $30,000 - $40,000 before incentives. * **Scenario 3: Rural Property with Limited Grid Access** * **Solar Panel Recommendation:** LG NeON 2 Black. These panels are known for their aesthetic appeal and durability. They're a good choice for homeowners who want a sleek-looking system that can withstand harsh weather conditions. * **Installation Scenario:** This homeowner lives in a rural area with unreliable grid access. They want to install a solar system with battery storage to ensure a reliable power supply. * **Financing:** A government-backed loan (PACE) might be a good option here, as the loan is tied to the property. They might also consider a specific solar loan that includes financing for battery storage. * **Price:** A 7kW system with LG NeON 2 Black panels and battery storage could cost around $25,000 - $35,000 before incentives.Product Comparison:

* **REC Group Alpha Series:** Good balance of performance and cost. Reliable and efficient. * **SunPower A-Series:** Highest efficiency and longest warranty. Premium option. * **LG NeON 2 Black:** Aesthetically pleasing and durable.Pricing Disclaimer: These prices are estimates and can vary depending on location, installer, and other factors. Always get multiple quotes from qualified solar installers.

Maximizing Savings Through Solar Incentives Tax Credits and Rebates

Don't forget about the incentives! The federal government offers a tax credit for solar panel installations, and many states and local governments offer additional rebates and incentives. These can significantly reduce the upfront cost of your solar system and make financing even more manageable.

For example, the federal solar tax credit (also known as the Investment Tax Credit or ITC) allows you to deduct a percentage of the cost of your solar system from your federal taxes. This can be a huge savings!

Be sure to research the incentives available in your area and factor them into your financing calculations.

The Long-Term Benefits of Solar Power Reduced Electricity Bills and Increased Property Value

Going solar isn't just about saving money upfront; it's about long-term financial benefits. Once your solar panels are installed, you'll start generating your own electricity, which means lower electricity bills. In some cases, you might even eliminate your electricity bill entirely!

Plus, solar panels can increase your property value. Homes with solar panels are often more attractive to buyers, and they can command a higher price on the market.

So, when you're considering solar panel financing, remember that you're not just taking out a loan; you're investing in your future.

Navigating the Solar Loan Application Process and Choosing the Right Lender

Applying for a solar loan is similar to applying for any other type of loan. You'll need to gather your financial information, compare offers from different lenders, and choose the loan that best fits your needs.

Here are some tips for navigating the application process:

* **Check your credit score:** Your credit score will play a big role in determining your interest rate and eligibility for a loan. * **Shop around:** Get quotes from multiple lenders and compare their terms and fees. * **Read the fine print:** Make sure you understand all the terms and conditions of the loan before you sign anything. * **Ask questions:** Don't be afraid to ask the lender any questions you have about the loan.Alternative Financing Options for Solar Panel Installation Leasing and PPAs

While green loans are a popular option, there are other ways to finance your solar panel system. Two common alternatives are leasing and Power Purchase Agreements (PPAs).

* **Leasing:** With a solar lease, you don't own the solar panels. Instead, you pay a monthly fee to lease them from a solar company. This can be a good option if you don't want to deal with the upfront costs and maintenance of owning a solar system. * **PPAs:** With a PPA, you agree to purchase the electricity generated by the solar panels at a fixed rate. The solar company owns and maintains the system. This can be a good option if you want to save money on your electricity bill without having to invest in a solar system yourself.However, keep in mind that with leasing and PPAs, you won't be eligible for the federal tax credit or other incentives.

Future Trends in Solar Panel Financing and Green Energy Investments

The world of solar panel financing is constantly evolving. As solar technology becomes more affordable and accessible, we can expect to see even more innovative financing options emerge.

For example, some companies are now offering crowdfunding platforms for solar projects, allowing individuals to invest in solar energy and earn a return on their investment.

And as governments and businesses become more committed to sustainability, we can expect to see even more green loans and other financial incentives for solar panel installations.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)