Solar Panel and Depreciation: Understanding the Tax Benefits

Understanding Solar Panel Depreciation The Basics

Alright, let's dive into the exciting world of solar panel depreciation! I know, tax talk isn't exactly a beach vacation, but trust me, understanding this can save you some serious cash. So, what is depreciation anyway? In simple terms, it's the gradual decrease in value of an asset over time due to wear and tear, obsolescence, or simply the passage of time. Think of your car – it's worth less each year you drive it. Solar panels are similar, although they hold their value pretty well compared to a car. The IRS allows you to deduct a portion of the cost of your solar panel system each year as depreciation. This deduction reduces your taxable income, which means lower taxes! Sweet, right?

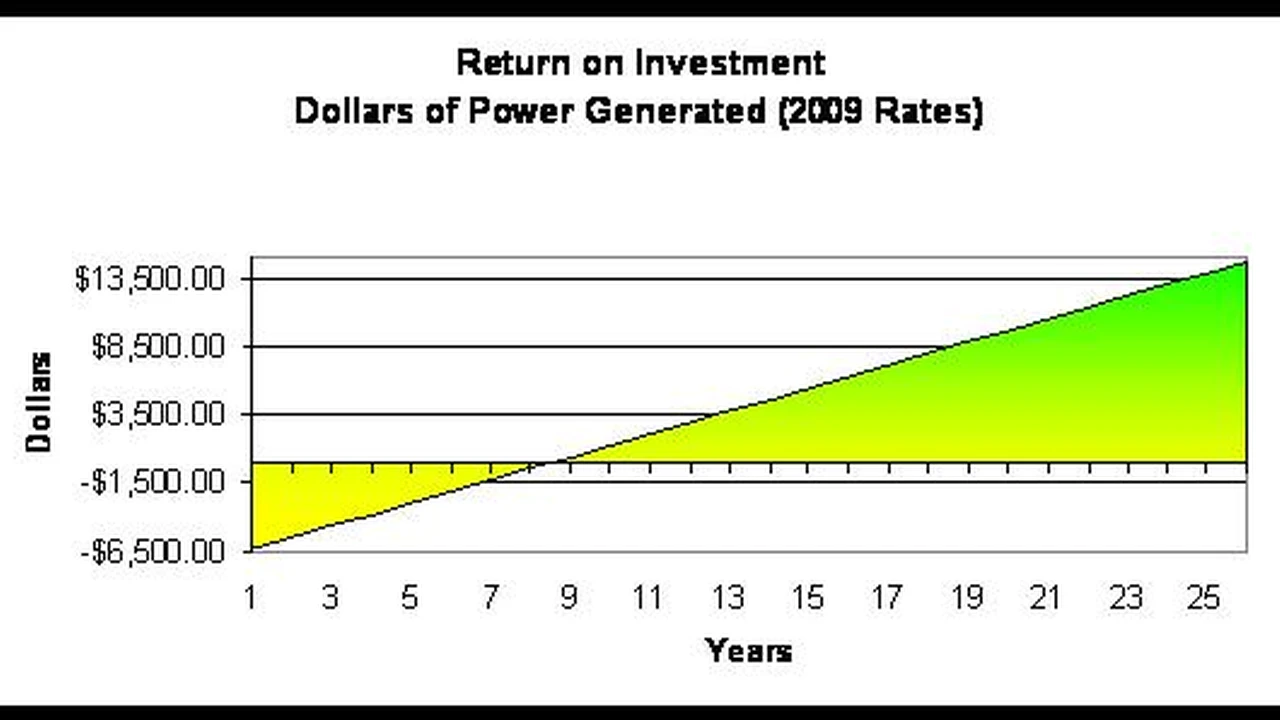

Now, why is this a big deal for solar panel owners? Well, installing solar panels is a significant investment. Being able to depreciate the system helps offset the initial cost and makes solar even more financially attractive. It's like getting a little bit of your money back each year. The amount you can depreciate depends on several factors, including the cost of the system, the depreciation method used, and any applicable tax incentives. We'll get into those details shortly.

Federal Tax Incentives The Investment Tax Credit ITC

Before we get deep into depreciation, let's talk about the Investment Tax Credit (ITC). This is a HUGE deal. Currently, the ITC allows you to deduct 30% of the cost of your solar panel system from your federal taxes. Yes, you read that right, 30%! This applies to both residential and commercial solar installations. So, if your system costs $20,000, you can deduct $6,000 from your federal taxes. That's a significant chunk of change! The ITC is a direct tax credit, meaning it reduces your tax liability dollar-for-dollar. There are some limitations, of course. You can't claim the ITC for more than your tax liability. However, any unused credit can usually be carried forward to future tax years. The ITC is a powerful incentive that makes going solar even more appealing.

Now, how does the ITC relate to depreciation? Good question! You can claim both the ITC and depreciation on your solar panel system. However, you need to reduce the depreciable basis of the system by half of the ITC amount. Let's say your system costs $20,000, and you claim a $6,000 ITC. Your depreciable basis would be $20,000 - ($6,000 / 2) = $17,000. This is the amount you'll use to calculate your annual depreciation deduction. Don't worry, we'll walk through some examples later.

Depreciation Methods For Solar Panels MACRS and Straight-Line

Okay, let's get into the nitty-gritty of depreciation methods. The IRS allows you to use different depreciation methods for your solar panel system. The most common are the Modified Accelerated Cost Recovery System (MACRS) and the straight-line method. MACRS allows you to deduct a larger portion of the cost in the early years of the asset's life and a smaller portion in later years. The straight-line method allows you to deduct the same amount each year over the asset's useful life.

For solar panels, the MACRS method typically uses a 5-year recovery period. This means you can depreciate the system over 5 years. The IRS provides a table of depreciation percentages for each year of the 5-year recovery period. The percentages are based on a half-year convention, which means you only get to depreciate half of the asset's value in the first year. The specific percentages can vary slightly depending on the year the system was placed in service, so be sure to check the latest IRS guidelines.

The straight-line method is simpler to calculate. You simply divide the depreciable basis by the useful life of the asset. For solar panels, the IRS typically uses a 20-year useful life. So, if your depreciable basis is $17,000, your annual depreciation deduction would be $17,000 / 20 = $850. The straight-line method provides a more consistent deduction over the life of the system, but it doesn't allow you to deduct as much in the early years compared to MACRS.

Which method should you choose? It depends on your individual tax situation. MACRS will generally result in larger deductions in the early years, which can be beneficial if you have a higher tax liability in those years. The straight-line method provides a more consistent deduction, which can be helpful for long-term tax planning. It's always a good idea to consult with a tax professional to determine which method is best for you.

Calculating Solar Panel Depreciation Step-by-Step Examples

Alright, let's put all this theory into practice with some examples. Let's say you install a solar panel system that costs $20,000. You claim the 30% ITC, which is $6,000. Your depreciable basis is $20,000 - ($6,000 / 2) = $17,000.

Example 1: MACRS Method

Using the 5-year MACRS method, let's assume the depreciation percentages are as follows (these are illustrative and may vary, consult IRS tables):

- Year 1: 20%

- Year 2: 32%

- Year 3: 19.2%

- Year 4: 11.52%

- Year 5: 11.52%

- Year 6: 5.76%

Your depreciation deductions would be:

- Year 1: $17,000 * 20% = $3,400

- Year 2: $17,000 * 32% = $5,440

- Year 3: $17,000 * 19.2% = $3,264

- Year 4: $17,000 * 11.52% = $1,958.40

- Year 5: $17,000 * 11.52% = $1,958.40

- Year 6: $17,000 * 5.76% = $979.20

Example 2: Straight-Line Method

Using the straight-line method with a 20-year useful life, your annual depreciation deduction would be:

$17,000 / 20 = $850 per year

As you can see, the MACRS method provides larger deductions in the early years compared to the straight-line method. This can be especially beneficial if you have a higher tax liability in the early years of your solar panel system's life.

Claiming Depreciation on Your Taxes Form 4562 and Schedule C

So, how do you actually claim depreciation on your taxes? You'll need to use IRS Form 4562, Depreciation and Amortization. This form is used to calculate and report depreciation deductions. You'll need to provide information about your solar panel system, including the cost, the date it was placed in service, the depreciation method used, and the recovery period.

If you're a business owner, you'll also need to report the depreciation deduction on Schedule C, Profit or Loss From Business (Sole Proprietorship). This schedule is used to report the income and expenses of your business. The depreciation deduction will reduce your taxable income, which will lower your tax liability.

It's important to keep accurate records of your solar panel system's cost and installation date. You'll also need to keep records of any repairs or improvements you make to the system. These records will be helpful when you calculate your depreciation deduction and file your taxes.

State and Local Incentives Impact on Depreciation

Don't forget about state and local incentives! Many states and local governments offer incentives for solar panel installations, such as tax credits, rebates, and grants. These incentives can further reduce the cost of your solar panel system and make it even more financially attractive. However, some state and local incentives may affect the depreciable basis of your system. For example, if you receive a state rebate, you may need to reduce the cost of your system by the amount of the rebate before calculating your depreciation deduction.

Be sure to research the state and local incentives available in your area and understand how they may affect your depreciation deduction. Your state's energy office or your solar installer can provide more information about these incentives.

Solar Panel Products Recommendations Comparisons and Pricing

Okay, let's talk about some specific solar panel products and their applications. Choosing the right solar panels is crucial for maximizing your energy production and savings.

SunPower Maxeon Panels: These are often considered the gold standard in solar panels. They're known for their high efficiency, durability, and long lifespan. They use a unique copper foundation that makes them incredibly resistant to corrosion and cracking. Ideal for: Homeowners who want the best performance and are willing to pay a premium. Homes with limited roof space. Typical Cost: $3.00 - $4.00 per watt.

LG NeON Panels: LG is another well-respected brand in the solar industry. Their NeON panels are known for their high power output and excellent performance in low-light conditions. They also come with a long warranty. Ideal for: Homeowners who want high performance and reliability. Areas with frequent cloudy days. Typical Cost: $2.80 - $3.50 per watt.

Panasonic EverVolt Panels: Panasonic panels are known for their reliability and durability. They offer a good balance of performance and price. Ideal for: Homeowners who want a reliable and cost-effective solar solution. Typical Cost: $2.50 - $3.20 per watt.

REC Alpha Series Panels: REC panels are a popular choice for their good performance and competitive price. They use half-cut cell technology, which improves efficiency and reduces shading losses. Ideal for: Homeowners who want a good value for their money. Areas with partial shading. Typical Cost: $2.30 - $3.00 per watt.

Canadian Solar Panels: Canadian Solar is a large and well-established solar panel manufacturer. They offer a wide range of panels at different price points. Ideal for: Homeowners who are looking for a budget-friendly solar solution. Large-scale solar projects. Typical Cost: $2.00 - $2.70 per watt.

Solar Panel Performance and Degradation Understanding Lifespan

All solar panels degrade over time. This means their power output will gradually decrease as they age. The rate of degradation varies depending on the panel's quality and the environmental conditions. High-quality panels typically have a lower degradation rate. Most manufacturers guarantee a certain percentage of power output after 25 years. For example, SunPower guarantees that their Maxeon panels will produce at least 92% of their original power output after 25 years. This is significantly higher than many other panels on the market.

Understanding the lifespan and degradation rate of your solar panels is important for calculating your long-term energy savings. A panel with a lower degradation rate will produce more energy over its lifetime, resulting in greater savings.

Maintenance and Repair Costs Affecting Depreciation

While solar panels are generally low-maintenance, they may require occasional cleaning or repairs. Dirt, dust, and debris can accumulate on the panels, reducing their efficiency. Cleaning the panels can help restore their performance. In some cases, panels may need to be repaired or replaced due to damage or failure.

The cost of maintenance and repairs can affect the overall economics of your solar panel system. It's important to factor these costs into your calculations when determining the return on investment. However, the good news is that solar panels are generally very reliable, and major repairs are rare.

Financing Options Solar Loans Leases and PPAs

There are several financing options available for solar panel installations, including solar loans, leases, and power purchase agreements (PPAs). Solar loans allow you to borrow money to purchase the system outright. Solar leases and PPAs allow you to use the system without owning it. With a lease, you pay a fixed monthly fee for the use of the system. With a PPA, you pay for the electricity generated by the system at a set rate.

The financing option you choose can affect your eligibility for the ITC and depreciation. If you purchase the system with a solar loan, you're eligible for both the ITC and depreciation. If you lease the system or enter into a PPA, you typically aren't eligible for these incentives, as you don't own the system. The ownership of the system is what determines who can claim these tax benefits.

Future of Solar Incentives and Tax Benefits

The future of solar incentives and tax benefits is always subject to change. The ITC is currently scheduled to remain at 30% through 2032, after which it will step down to 26% in 2033 and 22% in 2034. After 2034, the ITC for residential solar will expire, while the ITC for commercial solar will remain at 10%. It's possible that Congress could extend or modify the ITC in the future, but there's no guarantee. Staying informed about the latest policy changes is important.

Changes in state and local incentives are also possible. Some states may increase or decrease their incentives depending on their budget and energy policy goals. It's important to stay informed about the latest developments in your area.

Do-It-Yourself vs Professional Installation Considering Depreciation

You might be tempted to install your solar panels yourself to save money. While DIY solar installations are possible, they come with significant challenges. You need to have the necessary skills and knowledge to properly install the system. Improper installation can lead to safety hazards and reduced performance. It can also void the warranty on your solar panels.

Professional installation is generally recommended. A professional installer will have the experience and expertise to properly install your system. They'll also be able to handle the permitting and inspection process. While professional installation costs more upfront, it can save you money in the long run by ensuring that your system is installed correctly and operates efficiently.

When considering depreciation, it's important to factor in the cost of installation. The installation cost is included in the total cost of the system, which is used to calculate the depreciable basis. So, whether you choose DIY or professional installation, the cost will affect your depreciation deduction.

This information is for educational purposes only and is not intended as tax advice. Consult with a qualified tax professional for personalized advice regarding your specific situation.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)